Borrowing

Borrow intents are loan requests that can be automatically matched with prospective lenders.

Introduction

In Astaria, users are able to create borrowing intents under specified parameters. These intents will be publicly broadcasted to the intent feed to be filled by prospective lenders.

It is possible to request loans using any ETH-based asset as collateral (ERC20s and NFTs), and borrow any ERC20 against it.

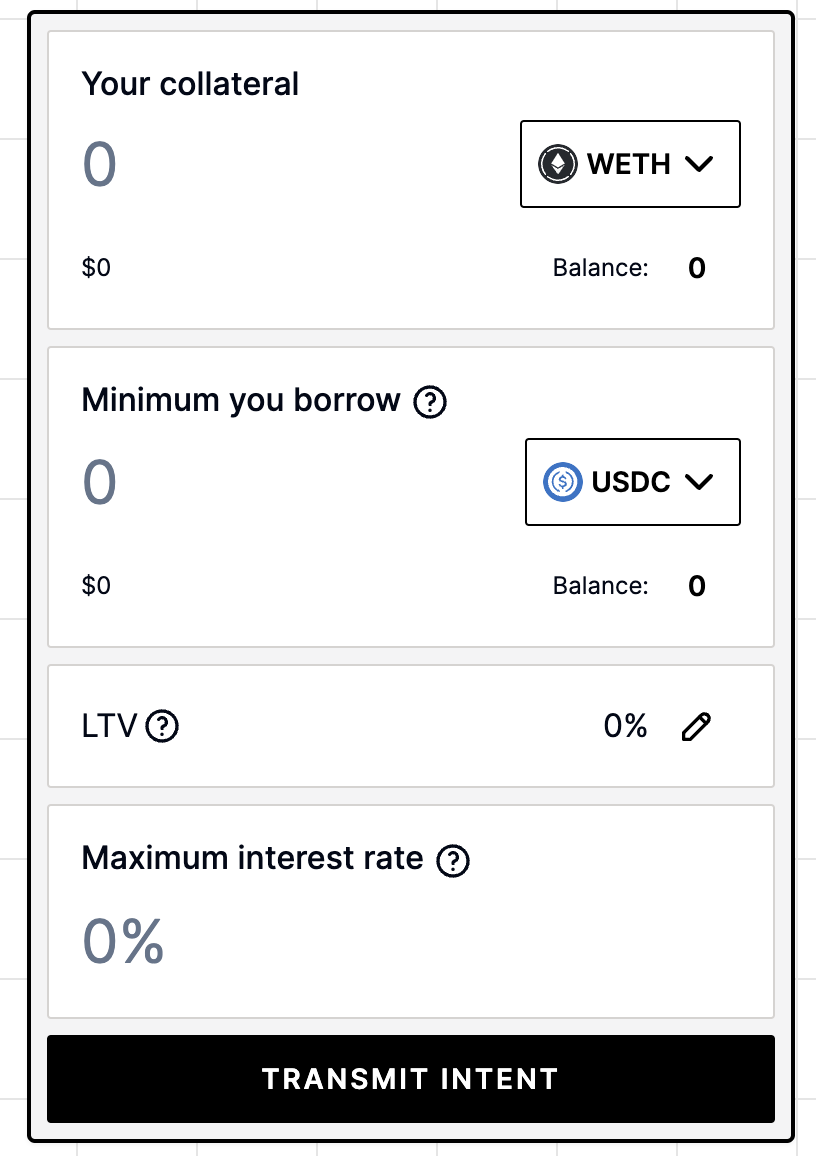

Step 1: Transmitting the borrow intent

Users will define the key parameters of the intent, specifying:

Collateral: The amount and type of asset that will be used to secure the loan

Borrow amount: The requested asset and total

Interest rate: The maximum APY that a prospective lender will receive. This will begin the 24 hour period at 0%, and gradually increase up to the percentage specified in this field.

LTV: The LTV will be automatically calculated based on the above fields; however, it can also be directly edited to adjust the borrow amount to meet a desired threshold.

The lower your LTV and the higher your interest rate, the more likely you are to have your intent filled by a lender.

When the above information is submitted through the Astaria application, the user will sign an EIP-712 message off-chain through their connected wallet to confirm the intent. This signed message is gas-free, though users will have to approve the collateral token before proceeding.

Step 2: Allow the loan auction to proceed

The finalized intent will then enter the intent feed, where potential lenders have 24 hours to fill the loan.

Over this 24 hour period, the proposal will be live with a starting interest rate of 0%, and ending with an interest rate that matches the maximum interest rate requested.

The interest rate will increase continuously until a lender decides to accept the loan terms, or the 24 hour period ends and the intent expires.

It is also possible for borrowers to cancel intents before they are filled via the Astaria UI.

Step 3: Monitoring the loan

If a lender accepts your loan terms, your loan will execute automatically. The collateral will leave the wallet, and the borrowed token will be deposited back into the same wallet address.

Borrowers have the ability to repay their loan at any time throughout the loan's lifecycle.

Once a lender has been matched, the lender can hold a recall auction after a 24 hour honeymoon period.

Additional notes

Open Term & Recall: Loans in Astaria v1 are open term but can be recalled. Once a lender has been matched, the lender can hold a recall auction.

Last updated